[ad_1]

SUIXI, CHINA – DECEMBER 30: An employee works on the production line of aluminum foil at a workshop of Anhui Limu New Material Technology Co., Ltd on December 30, 2023 in Suixi County, Huaibei City, Anhui Province of China. (Photo by Li Xin/VCG via Getty Images)

Vcg | Visual China Group | Getty Images

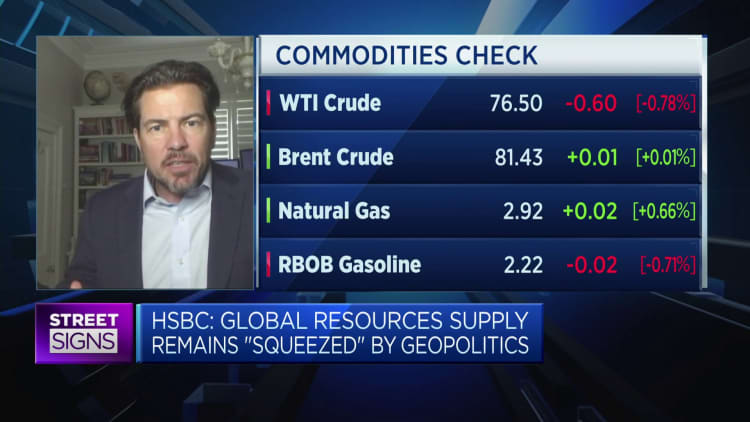

Global commodity markets are in a “super squeeze” amid supply disruptions and lack of investment — and it’s only going to get worse as geopolitical and climate risks exacerbate the situation, HSBC said.

“For some time now we have described global commodity markets as being in a ‘super-squeeze,'” its chief economist Paul Bloxham told CNBC.

A commodity “super squeeze” is denoted by higher prices driven by supply constraints more than a robust growth in demand, he explained.

“If it’s a supply constraint that’s driving high commodity prices, it’s a very different story for global growth,” he told CNBC via Zoom. Higher prices as a result of a super squeeze are “not as positive.”

“We see the deeper ‘super-squeeze’ factors on the supply-side as still set to play a key role in keeping commodity prices elevated,” he said, outlining factors like political uncertainties, climate change and the lack of investments into the green energy transition.

The super squeeze could be deeper, or more prolonged if geopolitical, climate change or energy transition related supply disruptions are larger than expected.

Paul Bloxham

HSBC chief economist

Geopolitical risks include the ongoing Israel-Hamas conflict in Gaza and the Ukraine war, which have hampered global trade, as seen in shipping disruptions from the recent Houthi attacks in the Red Sea.

Another reason is climate change, which disrupts supply chains as well as commodities supply, especially in the agricultural space.

“The super squeeze could be deeper, or more prolonged if geopolitical, climate change or energy transition related supply disruptions are larger than expected,” he added.

Lack of investments

The world’s pursuit of a net-zero carbon future is fueling demand for energy transition metals such as copper and nickel, Bloxham pointed out.

However, there are insufficient investments allocated to procuring these critical minerals, leading to a sharper supply squeeze on energy transition metals — in particular copper, aluminum and nickel, he said.

As energy transition ramps up, markets could be looking at a shortage of a slew of metals like graphite, cobalt, copper, nickel and lithium in the next decade, the Energy Transitions Commission said in a report in July.

At the recent COP28 climate change conference, more than 60 countries backed a plan to triple global renewable energy capacity by 2030, in what is largely deemed as a step forward for energy transition and a further boost in demand for metals required for that transition.

“Large-scale mining projects can take 15-20 years, and the last decade has seen a lack of investment in exploration and production for key energy transition materials,” the report said.

Annual capital investments in these metals averaged $45 billion in the last two decades, and must rise to around $70 billion each year through to 2030 to ensure an ample stream of supply, according to the ETC report.

Commodities are notoriously volatile asset classes, with a long history that is prone to a short squeeze and the current landscape points to more of the same.

Brian Luke

S&P Dow Jones Indices

Without more investment in new capacities, supply will be constrained, HSBC’s Bloxham said, adding that “for any given amount of demand,” it should be expected that commodity prices will stay more elevated than in the past.

“That seems to be playing out across many of the commodities at the moment.”

Technology could also be a gamechanger if a development came along and made it much easier to extract the metals used in the battery space, Bloxham added.

Iron ore site in Australia.

Ian Waldie | Bloomberg via Getty Images

He did not say how long it will take global commodity markets to move out of the squeeze, but one way out of it — which would also push commodity prices lower — is a “bigger and deeper [economic] downturn globally,” he said.

“Commodities are notoriously volatile asset classes, with a long history that is prone to a short squeeze and the current landscape points to more of the same,” said Brian Luke, senior director and head of commodities at S&P Dow Jones Indices. He highlighted that extreme weather events and geopolitics have also impacted the agricultural and energy commodity baskets.

Metals most impacted

Analysts say metals will likely see the most upside.

Bloxham noted that aside from clean energy metals, iron ore was also on his list due to falling inventory and a lack of investments into expanding capacity.

Iron ore has seen a price jump of over 24% in the last year, according to data from FactSet. The benchmark 62%-grade iron ore last traded at $135.48 per ton.

“The reason why [iron ore] has a sudden squeeze-up is because inventory has been very low,” said Bank of America Securities’ head of Asia -Pacific basic materials, Matty Zhao.

She noted that in spite of China’s property crisis, steel production has continued, fueling demand for iron ore and coking coal, which are integral to steelmaking.

China, which makes around 55% of the world’s steel, produced 874.7 million tons of steel in the first 10 months of 2023 — up 1.4% across the same period in 2022.

What squeeze?

While risks remain, one analyst is of the view that commodity markets are still “adequately supplied” for the most part.

“The commodity markets are currently focused on slumping demand due to the sluggish global economy. As such, there’s not too much concern about supplies,” said Arlan Suderman, chief commodities economist at financial services firm StoneX.

Oil, for one, saw an increase in global oil inventories in 2023.

Some are still hoping that a rebound in Chinese demand will .

“A resurgence from Asia will go a long way in determining if commodities will have a breakout year,” said S&P’s Luke, adding that 2023 saw a year of unfulfilled demand from China which weighed heavily on commodity markets.

[ad_2]

Source link